In Partnership With

A Tax Efficient Section 12B Investment with Long-Term Income

Explore a de-risked investment structure in high-performing solar assets, designed to provide significant upfront tax benefits and a projected 20-year passive income stream.

Join 350+ sophisticated investors | R366M+ in Section 12BA Deductions Facilitated

Early Investor Bonus

Investments confirmed before 30 September 2025 are eligible for an additional once-off 10% annualised return bonus.

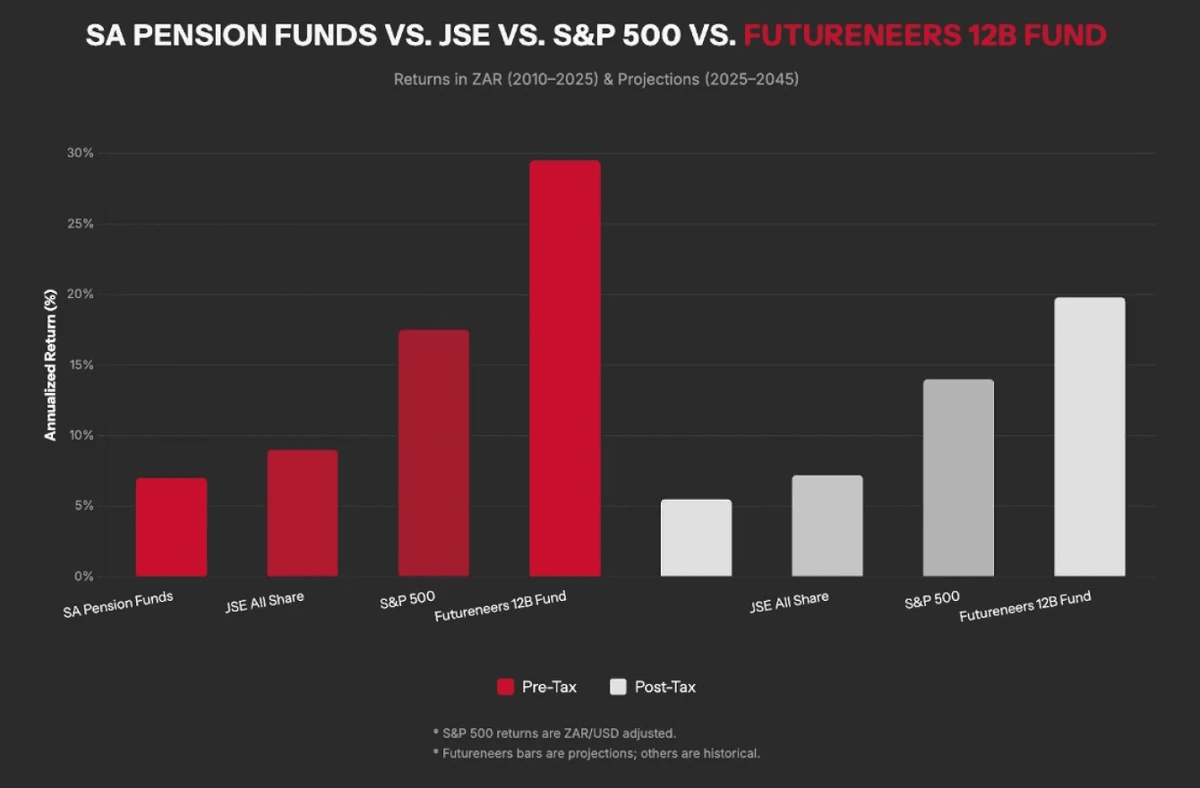

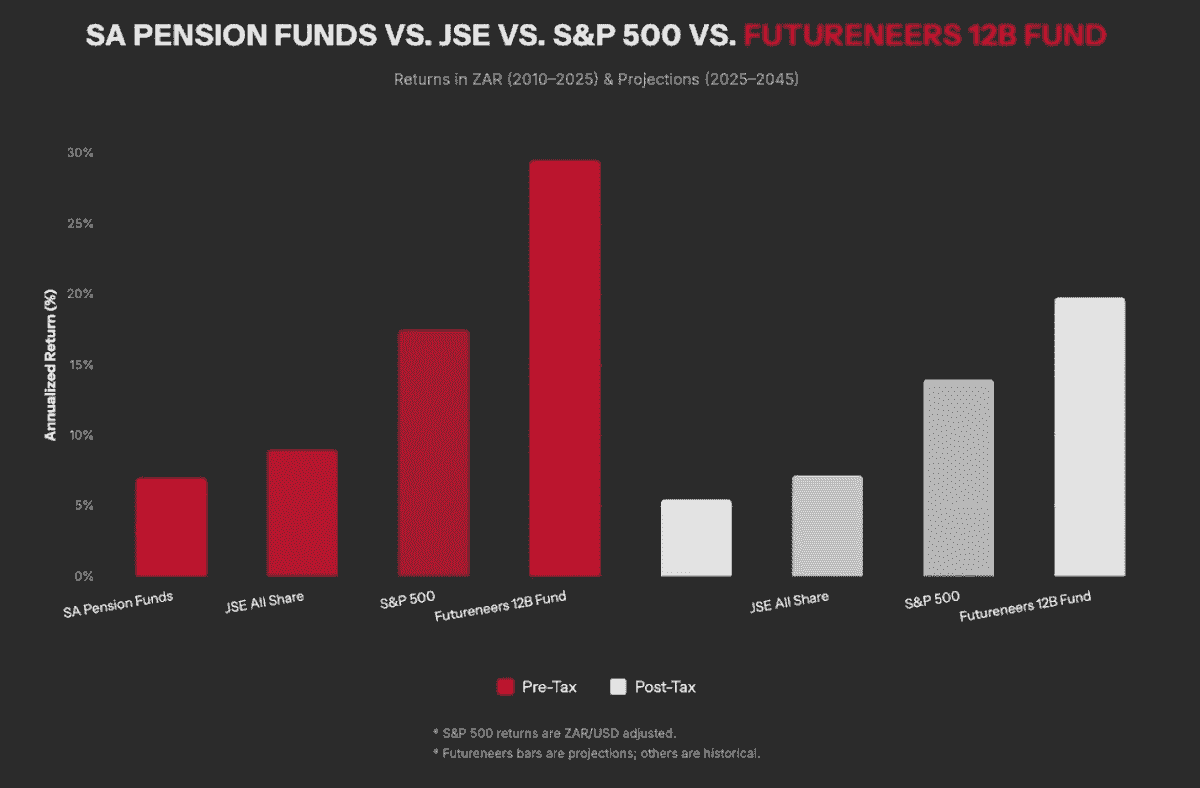

The Challenge with Traditional Portfolios

In today's economic climate, traditional South African investment vehicles often face a trade-off between meaningful growth and acceptable risk. Many sophisticated investors are now seeking alternative asset classes that are uncorrelated to public markets and offer superior, tax-optimised returns.

Our 3-Phase Investment Strategy

The Futureneers Smart-Debt Fund utilises a 3-phase model to balance upfront liquidity, capital preservation, and long-term income generation from renewable energy assets.

Phase 1: Upfront Liquidity (Year 0)

The structure is designed to provide a 167% tax deduction under Section 12B, resulting in a projected 75% immediate cash-back benefit for a 45% tax-bracket investor.

Phase 2: Capital Preservation (Years 1-5)

Accelerated cash distributions (projected avg. 20% p.a.) are prioritised to return the initial at-risk capital to zero, typically within the first five years.

Phase 3: Passive Income Generation (Years 6-20)

Once risk capital is repaid, the investment transitions to generating a 15-year passive income stream, with targeted returns increasing year-on-year.

Projected Performance & Track Record

Our fund's structure is built on a foundation of proven assets and a clear strategy. Below are our key delivery metrics and targeted performance against market.

Our Track Record of Delivery

R850M+

Capital Raised

350+

High-Net-Worth Clients

R350M+

In Solar Assets Commissioned

100%

Capital-to-Asset Implementation

Please note: The performance chart represents projected targets and is not a guarantee of future returns. Historical data for benchmarks is provided for context only.

A Structure Designed for Risk Mitigation

Effective risk management is paramount. The "Smart-Debt" structure is our key differentiator, engineered to provide investor oversight and limit exposure to external variables.

1Limited Third-Party Debt Exposure

External, uncontrollable bank debt is structurally limited to just 33% of the total required funding.

2Investor Control & Oversight

The majority of the debt is funded via a loan company that investors, alongside Futureneers, control. This aligns interests and provides direct oversight of repayment.

3High-Quality Contracted Assets

The fund commissions new solar assets with long-term Power Purchase Agreements (PPAs), anchored by portfolios from blue-chip listed companies like the ADvTECH group.

Frequently Asked Questions

What is the minimum investment?

What are the primary investment risks?

What is the fee structure?

Receive the Full Investment Memorandum

For a comprehensive overview of the fund structure, financial projections, and risk factors, please provide your details to receive the full investment memorandum.

Early Investor Bonus: Investments confirmed before 30 September 2025 are eligible for an additional once-off 10% annualised return bonus.

An expert from our team will be in touch to schedule a private, no-obligation consultation.

Futureneers is s a collaboration of like-minded entrepreneurs, to invest, do deals, start and grow businesses and then give back to other entrepreneurs and those less fortunate - driven by profits, but never sacrificing ethics, while always having fun doing it!

*©2020-2025 Futureneers™

*Futureneers Capital is a registered Financial Services Provider (FSP 46996) and registered Section 12J Venture Capital Company | Investments is by Invitation only | Minimum Investment: R1m | Funding available to qualifying investors limited to specific investment products and NCR terms and conditions | All calculations presented herein assumes a maximum section 12J or Section 12BA Tax benefit of 45%..]

*RETURNS ARE TARGETS ONLY AND CANNOT BE GUARANTEED. INVESTORS ARE STRONGLY ADVISED TO OBTAIN EXTERNAL LEGAL, TAX AND FINANCIAL ADVISE AND REQUEST THE VARIOUS INVESTMENT DECKS AND LEGAL AGREEMENTS FOR FURTHER REVIEW AND DETAILED ANALYSIS BY THEIR ADVISORS.